The hardware and bandwidth for this mirror is donated by METANET, the Webhosting and Full Service-Cloud Provider.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]metanet.ch.

The Largevars R package conducts a cointegration test for high-dimensional vector autoregressions of order \(k\) based on the large \(N,T\) asymptotics of Bykhovskaya and Gorin (2021, doi:10.48550/arXiv.2006.14179), Bykhovskaya and Gorin (2022, doi:10.48550/arXiv.2202.07150). The implemented test is a modification of the Johansen likelihood ratio test. In the absence of cointegration the test converges to the partial sum of the Airy\(_1\) point process. This package contains simulated quantiles of the first ten partial sums of the Airy\(_1\) point process that are precise up to the first \(3\) digits.

You can install the latest version of Largevars from Github:

library(devtools)

install_github("eszter-kiss/Largevars")You can also install the latest CRAN release:

install.packages("Largevars")The following example is a replication of the S&P100 example from Bykhovskaya and Gorin (2022), Bykhovskaya and Gorin (2024).

We use logarithms of weekly adjusted closing prices of assets in the

S&P100 over ten years (01.01.2010-01.01.2020), which gives us \(\tau=522\) observations across time. The

S&P100 includes 101 stocks, with Google having two classes of

stocks. We use 92 of those stocks, those for which data were available

for our chosen time period. Only one of Google’s two listed stocks is

kept in the sample. Therefore, \(N =

92\), \(T = 521\) and \(T/N \approx 5.66\). The data that we use

are accessible from the data folder in the package.

library(Largevars)

## load data

data("s_p100_price")

## Transform data according to researcher needs

dataSP <- log(s_p100_price[, seq(2, dim(s_p100_price)[2])])

## Turn data frame into numeric matrix to match function requirements

dataSP <- as.matrix(dataSP)

## Use the package documentation by calling help

?largevar

## Use largevar function. Save the function output (list)

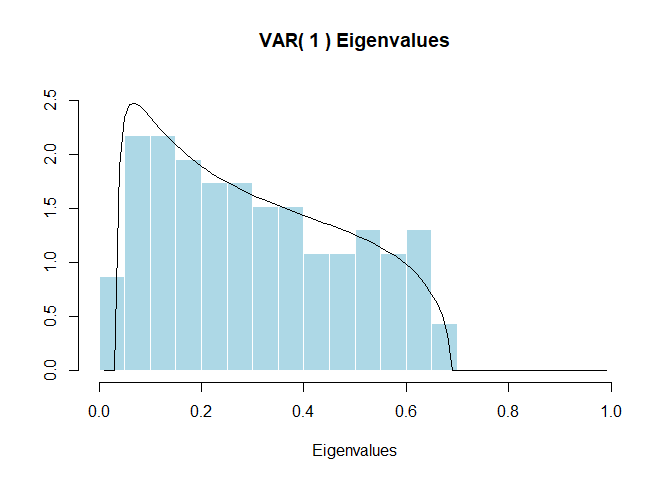

result <- largevar(data = dataSP, k = 1, r = 1, fin_sample_corr = FALSE,

plot_output = TRUE, significance_level = 0.05)

## Display the result

result

#> Output for the largevar function

#> =================================

#> Cointegration test for high-dimensional VAR(k) T= 521 N= 92

#>

#> 10% Crit. value 5% Crit. value 1% Crit. value Test stat.

#> 0.45 0.98 2.02 -0.28

#>

#> If the test statistic is larger than the quantile, reject H0.

#> ===============================================================

#> Test statistic: -0.2777314

#> The p-value is 0.23

#> Decision about H0: 0If we want to individually access certain values from the output list, we can do it in the usual way, by referencing the elements of the list:

result$significance_test$p_value

#> [1] 0.23

result$significance_test$boolean_decision

#> [1] 0

result$significance_test$significance_table

#> 10% Crit. value 5% Crit. value 1% Crit. value Test stat.

#> r=1 0.45 0.98 2.02 -0.2777314

#> r=2 -1.87 -1.09 0.42 -1.4995879

#> r=3 -5.90 -4.90 -2.99 -5.4154889

#> r=4 -11.35 -10.15 -7.87 -10.5527603

#> r=5 -18.07 -16.69 -14.07 -16.7460847

#> r=6 -25.95 -24.40 -21.45 -23.2178976

#> r=7 -34.90 -33.19 -29.95 -31.1080001

#> r=8 -44.88 -43.01 -39.47 -39.3197363

#> r=9 -55.82 -53.80 -49.99 -49.8419822

#> r=10 -67.70 -65.53 -61.45 -60.4894485If we want to see an empirical p-value, we can use the function

below. By default, it will print a message to console to remind the user

that precise computations of the statistics need a large number of

simulation iterations. We can suppress this message the usual way, by

using the suppressMessages() wrapper. We can set a seed for

the simulation by specifying a number for input seed.

## sim_function for empirical p-values

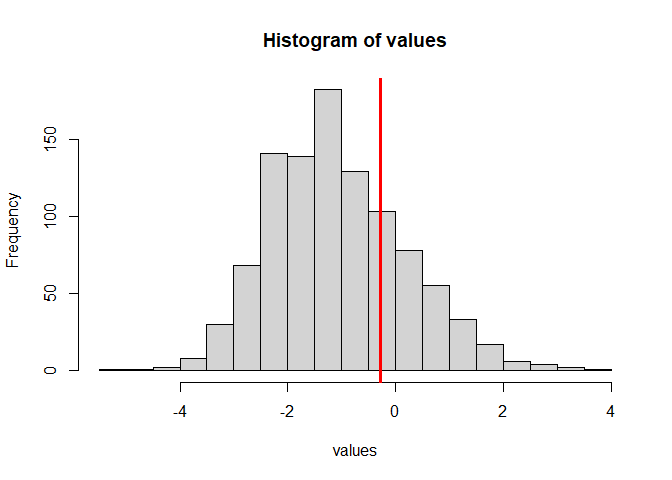

result2 <- sim_function(N = 92, tau = 522, stat_value = result$statistic,

k = 1, r = 1, fin_sample_corr = FALSE, sim_num = 1000, seed = 333)

#> Warning in check_input_simfun(N, tau, stat_value, k, r, fin_sample_corr, :

#> Simulation may run for several minutes

#> This function should only be used for quick approximate assessments, as precise computations of the statistics need much larger numbers of simulations.

## To provide the function while suppressing messages:

# result3 <- suppressMessages(sim_function(N=92,tau=522,stat_value=-0.2777,k=1,r=1,

# fin_sample_corr = FALSE,sim_num=1000, seed = 333))Anna Bykhovskaya (Duke University) anna.bykhovskaya@duke.edu

Vadim Gorin (University of California at Berkeley) vadicgor@gmail.com

Eszter Kiss (Duke University) ekiss2803@gmail.com

citation("Largevars")

#> To cite Largevars in publications use:

#>

#> Bykhovskaya A, Gorin V, Kiss E (2024). "Largevars: An R Package for

#> Testing Large VARs for the Presence of Cointegration." _TBD_.

#>

#> A BibTeX entry for LaTeX users is

#>

#> @Article{largevarspaper,

#> title = {Largevars: An R Package for Testing Large VARs for the Presence of Cointegration},

#> author = {Anna Bykhovskaya and Vadim Gorin and Eszter Kiss},

#> journal = {TBD},

#> year = {2024},

#> }MIT License (c) 2024

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.