The hardware and bandwidth for this mirror is donated by METANET, the Webhosting and Full Service-Cloud Provider.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]metanet.ch.

dfvad decomposes value added growth into explanatory

factors. A cost constrained value added function is defined to specify

the production frontier. Industry estimates can also be aggregated using

a weighted average approach.

dfvad is available from https://github.com/shipei-zeng/dfvad. To install it,

install_github from the devtools package can

be helpful.

devtools::install_github("shipei-zeng/dfvad")If error messages show that the URL cannot be opened, please set the download option before installing it.

options(download.file.method = "libcurl")If error messages show that schannel failed to receive handshake, please delete the previous package before updating it.

It has also been uploaded to the CRAN repository, which can be downloaded using:

install.packages("dfvad")value_decom() for decomposing nominal value added growth

identifies the contributions from efficiency change, growth of primary

inputs, changes in output and input prices, technical progress and

returns to scale.

library(dfvad)

# Use the built-in dataset "mining"

table1 <- value_decom(c("h2","x2"), c("w2","u2"), "y2", "p2", "year", mining)[[1]]

head(table1)

#> period value alpha beta gamma efficiency epsilon tau

#> 1 1991 1.0869517 1.0287049 0.9944262 1.0000000 1.0000000 1.0000000 1.062544

#> 2 1992 0.9960608 0.9523963 0.9874494 1.0000000 1.0000000 1.0000000 1.059140

#> 3 1993 1.0477108 1.0373754 1.0180111 0.9997303 0.9923619 0.9923619 1.000000

#> 4 1994 0.9773035 0.9605188 1.0444275 0.9996838 0.9670585 0.9745018 1.000000

#> 5 1995 1.0545680 0.9842271 1.0168128 0.9999874 1.0000000 1.0340636 1.019052

#> 6 1996 1.1345729 1.0406754 1.0327427 1.0000000 1.0000000 1.0000000 1.055662

#> TFPG

#> 1 1.0625440

#> 2 1.0591398

#> 3 0.9920943

#> 4 0.9741937

#> 5 1.0537516

#> 6 1.0556623

table2 <- value_decom(c("h2","x2"), c("w2","u2"), "y2", "p2", "year", mining)[[2]]

head(table2)

#> period value A B C E T TFP

#> 1 1990 1.000000 1.0000000 1.0000000 1.0000000 1.0000000 1.000000 1.000000

#> 2 1991 1.086952 1.0287049 0.9944262 1.0000000 1.0000000 1.062544 1.062544

#> 3 1992 1.082670 0.9797347 0.9819455 1.0000000 1.0000000 1.125383 1.125383

#> 4 1993 1.134325 1.0163527 0.9996314 0.9997303 0.9923619 1.125383 1.116486

#> 5 1994 1.108580 0.9762259 1.0440425 0.9994142 0.9670585 1.125383 1.087673

#> 6 1995 1.169073 0.9608280 1.0615958 0.9994016 1.0000000 1.146824 1.146138t_weight() follows a “bottom up” approach that uses

weighted averages of the sectoral decompositions to provide an

approximate decomposition into explanatory components at the aggregate

level.

library(dfvad)

# Use the built-in dataset "sector"

table1 <- t_weight("y", "p", "industry", "year", "alpha", "beta", "gamma", "epsilon", "tau", sector)[[1]]

head(table1)

#> period value alpha beta gamma epsilon tau TFPG

#> 1 1991 0.9951654 1.004989 0.9878890 0.9996087 0.9868727 1.016024 1.0023647

#> 2 1992 1.0145281 1.015884 0.9869371 0.9987753 0.9962747 1.016905 1.0118834

#> 3 1993 1.0656435 1.034633 1.0128698 1.0002431 1.0011899 1.015434 1.0168858

#> 4 1994 1.0649234 1.007479 1.0291213 1.0001043 1.0029142 1.024013 1.0271072

#> 5 1995 1.0565961 1.020031 1.0378505 1.0010086 0.9871089 1.010072 0.9980697

#> 6 1996 1.0703334 1.019766 1.0212297 0.9998535 1.0097033 1.018044 1.0277682

table2 <- t_weight("y", "p", "industry", "year", "alpha", "beta", "gamma", "epsilon", "tau", sector)[[2]]

head(table2)

#> period value A B C E T TFP

#> 1 1990 1.0000000 1.000000 1.0000000 1.0000000 1.0000000 1.000000 1.000000

#> 2 1991 0.9951654 1.004989 0.9878890 0.9996087 0.9868727 1.016024 1.002365

#> 3 1992 1.0096232 1.020952 0.9749843 0.9983845 0.9831963 1.033200 1.014276

#> 4 1993 1.0758984 1.056311 0.9875322 0.9986272 0.9843662 1.049147 1.031403

#> 5 1994 1.1457494 1.064211 1.0162904 0.9987313 0.9872349 1.074340 1.059361

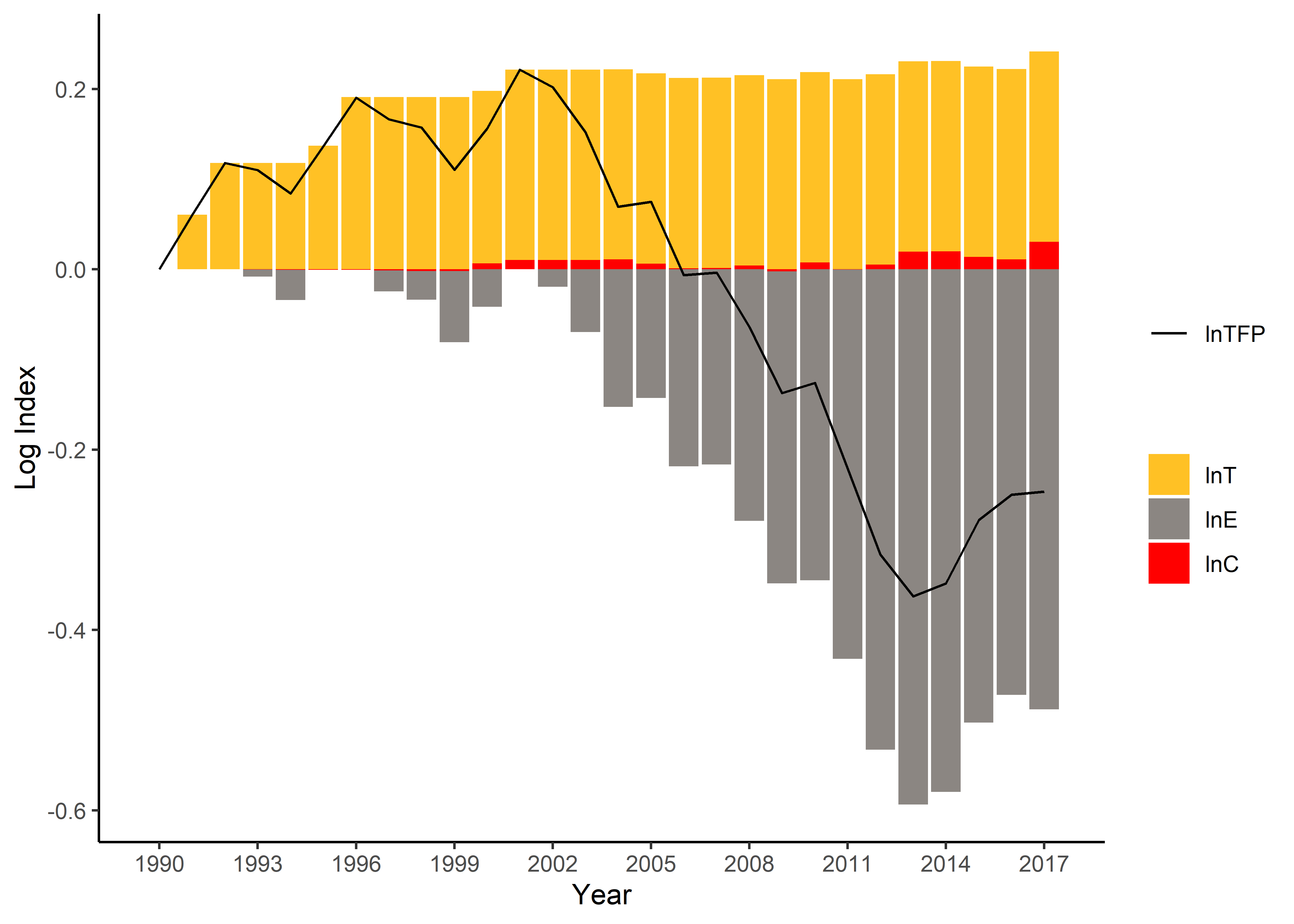

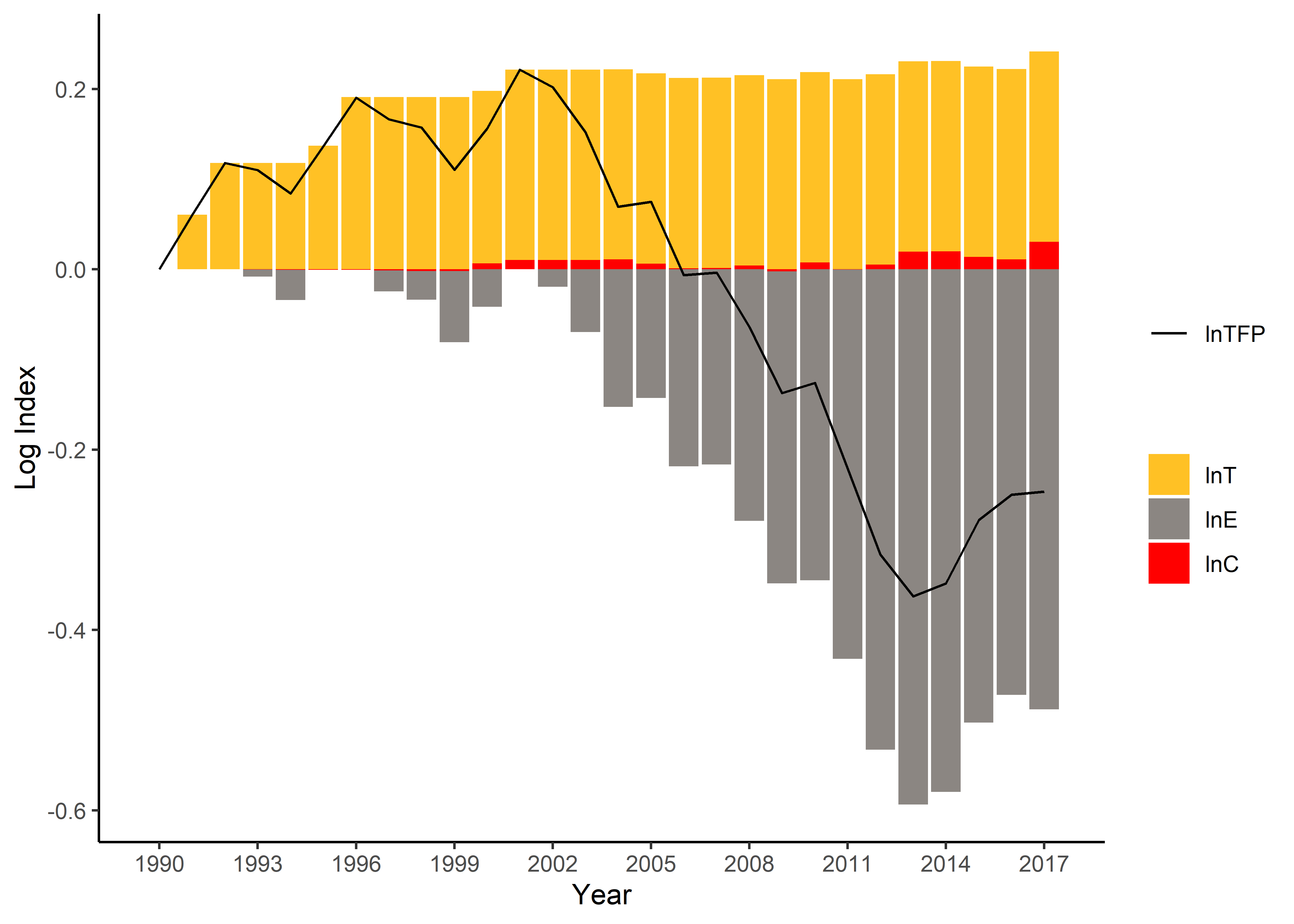

#> 6 1995 1.2105943 1.085528 1.0547575 0.9997387 0.9745083 1.085161 1.057317Here is an example to plot the explanatory factors of productivity

(logarithmic indexes). Additional packages such as ggplot2

and reshape2 are required.

library(dfvad)

library(ggplot2)

library(reshape2)

# Get the decomposition result

df <- value_decom(c("h2","x2"), c("w2","u2"), "y2", "p2", "year", mining)[[2]]

# Extract columns and rename

df_cmpt <- data.frame(df[,"period"], log(df[,c("T", "E", "C")]))

colnames(df_cmpt) <- c("year", "lnT", "lnE", "lnC")

df_tfp <- data.frame(df[,"period"], log(df[,"TFP"]))

colnames(df_tfp) <- c("year", "lnTFP")

# Set the colour scheme

palette_a <- c("goldenrod1", "seashell4", "red")

# Convert data into a tidy form

df_cmpt_tidy <- melt(df_cmpt, id.vars="year")

# Plot the components

plot_out <- ggplot(df_cmpt_tidy) + geom_bar(aes(x=year, y=value, fill=variable), stat="identity") +

geom_line(data=df_tfp, aes(x=year,y=lnTFP,color='black'), lwd=0.5) +

ylab('Log Index') + xlab('Year') +

scale_fill_manual("", values=palette_a) +

scale_colour_manual("", values=c('black'='black'), labels = c('lnTFP')) +

scale_x_continuous(breaks = seq(min(df$period), max(df$period), by = 3)) +

theme_classic()

print(plot_out)

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.