The hardware and bandwidth for this mirror is donated by METANET, the Webhosting and Full Service-Cloud Provider.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]metanet.ch.

The goal of fEGarch is to provide easy access to a broad

family of exponential generalized autoregressive conditional

heteroskedasticity (EGARCH) models both with either short or long

memory. The six most common conditional distributions, i.e. a normal

distribution, a t-distribution, a generalized error distribution, and

the skewed variants of those three, are available. Furthermore, we

introduce the average Laplace distribution and its skewed variant as

newly selectable conditional distributions. Overall, the EGARCH family

models are a strong competition to well-established GARCH-type models

and provide new ways to estimate conditional volatilities, while making

the prominent EGARCH and fractionally integrated EGARCH (FIEGARCH)

available as special cases. For convenience and the purpose of

comparison, fractionally integrated asymmetric power ARCH (FIAPARCH),

fractionally integrated Glosten-Jagannathan-Runkle GARCH (FIGJR-GARCH),

fractionally integrated threshold GARCH (FITGARCH) and fractionally

integrated GARCH (FIGARCH) models are available as well as their

short-memory variants (APARCH, GJR-GARCH, TGARCH, GARCH). Throughout,

the estimation method is quasi-maximum-likelihood estimation

(conditioned on presample values).

You can install the current version of the package from CRAN with:

install.packages("fEGarch")This is a basic example which shows you how to fit a model of the EGARCH family to the Standard and Poor’s 500 daily log-returns.

At first, specify a model from the EGARCH family using

fEGarch_spec().

library(fEGarch)

### 1. Set model specification via "fEGarch_spec()"

spec1 <- fEGarch_spec(

model_type = "egarch", # the basic model type among EGARCH and

# Log-GARCH as subclasses of the broad

# EGARCH family;

orders = c(1, 1), # the model orders;

long_memo = TRUE, # include long memory?;

cond_dist = "norm", # the conditional distribution;

powers = c(0, 0), # powers of the asymmetry and magnitude terms, respectively;

modulus = c(TRUE, TRUE) # whether or not to apply a modulus transformation

# to the asymmetry and magnitude terms, respectively

)

# -> Specification now aligns with that of FIMLog-GARCH(1, 1) with

# conditional normal distributionAfterwards, use the model specification returned by

fEGarch_spec() together with your data object and apply the

estimation function fEGarch() to them. As can be seen, the

package also imports and exports the pipe operator %>%

of the magrittr package for a simplified coding

workflow.

### 2. Use specification to fit model to data

rt <- SP500

model1 <- spec1 %>%

fEGarch(rt)

model1

#> *************************************

#> * Fitted EGARCH Family Model *

#> *************************************

#>

#> Type: egarch

#> Orders: (1, 1)

#> Modulus: (TRUE, TRUE)

#> Powers: (0, 0)

#> Long memory: TRUE

#> Cond. distribution: norm

#>

#> ARMA orders (cond. mean): (0, 0)

#> Long memory (cond. mean): FALSE

#>

#> Scale estimation: FALSE

#>

#> Fitted parameters:

#>

#> par se tval pval

#> mu 0.0003 0.0000 23.9025 0.0000

#> omega_sig -8.6599 0.1271 -68.1095 0.0000

#> phi1 0.8680 0.0227 38.1874 0.0000

#> kappa -0.2362 0.0146 -16.1675 0.0000

#> gamma 0.3194 0.0209 15.2989 0.0000

#> d 0.2754 0.0377 7.3053 0.0000

#>

#> Information criteria (parametric part):

#> AIC: -6.4945, BIC: -6.4880A convenient way to implement various specific model specifications

is available via a selection of wrappers for

fEGarch_spec(). They all only have the function arguments

orders and cond_dist from

fEGarch_spec().

### 3. Use shortcuts for submodel specifications

spec2 <- megarch_spec() # Specification for MEGARCH

spec3 <- mloggarch_spec() # Specification for MLog-GARCH

spec4 <- egarch_spec() # Specification for EGARCH

spec5 <- loggarch_spec() # Specification for Log-GARCH

spec6 <- fiegarch_spec() # Specification for FIEGARCH

spec7 <- filoggarch_spec() # Specification for FILog-GARCH

spec8 <- fimloggarch_spec() # Specification for FIMLog-GARCH

spec9 <- fimegarch_spec() # Specification for FIMEGARCH

# -> All with adjustable arguments "orders" and "cond_dist".

spec10 <- megarch_spec(orders = c(2, 1), cond_dist = "std")They can all be used in fEGarch(). In the following, the

previously created model specification spec10 is considered

for the log-returns. The other specifications can be applied

analogously.

model10 <- spec10 %>%

fEGarch(rt) # ... and so on for other specifications

model10

#> *************************************

#> * Fitted EGARCH Family Model *

#> *************************************

#>

#> Type: egarch

#> Orders: (2, 1)

#> Modulus: (TRUE, FALSE)

#> Powers: (0, 1)

#> Long memory: FALSE

#> Cond. distribution: std

#>

#> ARMA orders (cond. mean): (0, 0)

#> Long memory (cond. mean): FALSE

#>

#> Scale estimation: FALSE

#>

#> Fitted parameters:

#>

#> par se tval pval

#> mu 0.0004 0.0001 4.6743 0.0000

#> omega_sig -9.4104 0.1170 -80.4515 0.0000

#> phi1 0.9762 0.0719 13.5832 0.0000

#> phi2 -0.0000 0.0707 -0.0000 1.0000

#> kappa -0.2946 0.0266 -11.0709 0.0000

#> gamma 0.1651 0.0150 10.9784 0.0000

#> df 7.0906 0.6071 11.6790 0.0000

#>

#> Information criteria (parametric part):

#> AIC: -6.5391, BIC: -6.5316As a further extension, dual-models with autoregressive

moving-average (ARMA) model or fractionally integrated ARMA (FARIMA /

ARFIMA) model in the conditional mean simultaneously with error process

from the EGARCH family can be defined and estimated. For this purpose,

the mean_spec() function must be utilized in addition to

the previous steps.

spec_egarch <- egarch_spec()

spec_arma <- mean_spec(

orders = c(1, 1), # ARMA orders

long_memo = FALSE, # Long-memory?

include_mean = TRUE # Estimate uncond. mean?

)

model11 <- spec_egarch %>%

fEGarch(rt, meanspec = spec_arma)

model11

#> *************************************

#> * Fitted EGARCH Family Model *

#> *************************************

#>

#> Type: egarch

#> Orders: (1, 1)

#> Modulus: (FALSE, FALSE)

#> Powers: (1, 1)

#> Long memory: FALSE

#> Cond. distribution: norm

#>

#> ARMA orders (cond. mean): (1, 1)

#> Long memory (cond. mean): FALSE

#>

#> Scale estimation: FALSE

#>

#> Fitted parameters:

#>

#> par se tval pval

#> mu 0.0003 0.0000 8.2161 0.0000

#> ar1 0.2448 0.0081 30.2679 0.0000

#> ma1 -0.2944 0.0080 -36.6457 0.0000

#> omega_sig -9.1718 0.0641 -142.9765 0.0000

#> phi1 0.9719 0.0027 360.0481 0.0000

#> kappa -0.1333 0.0078 -17.1069 0.0000

#> gamma 0.1608 0.0124 12.9549 0.0000

#>

#> Information criteria (parametric part):

#> AIC: -6.4975, BIC: -6.4899Yet another alternative is the fitting of semiparametric extensions of conditional variance models. Modelling the conditional mean simultaneously via an ARMA or FARIMA model in such a semiparametric extension is currently not possible. The nonparametric, smooth scale function reflecting the unconditional standard deviation over time is estimated using automated local polynomial regression with two different algorithms for short-memory and long-memory errors.

model12 <- fiegarch_spec(cond_dist = "std") %>%

fEGarch(rt, use_nonpar = TRUE)

model12

#> *************************************

#> * Fitted EGARCH Family Model *

#> *************************************

#>

#> Type: egarch

#> Orders: (1, 1)

#> Modulus: (FALSE, FALSE)

#> Powers: (1, 1)

#> Long memory: TRUE

#> Cond. distribution: std

#>

#> ARMA orders (cond. mean): (0, 0)

#> Long memory (cond. mean): FALSE

#>

#> Scale estimation: TRUE (poly_order = 3; bandwidth = 0.1493)

#>

#> Fitted parameters:

#>

#> par se tval pval

#> omega_sig -0.5382 0.1812 -2.9698 0.0030

#> phi1 0.7907 0.0701 11.2815 0.0000

#> kappa -0.1519 0.0126 -12.0240 0.0000

#> gamma 0.1236 0.0121 10.2397 0.0000

#> d 0.3963 0.0846 4.6867 0.0000

#> df 7.5375 0.6688 11.2706 0.0000

#>

#> Information criteria (parametric part):

#> AIC: 2.4655, BIC: 2.4719

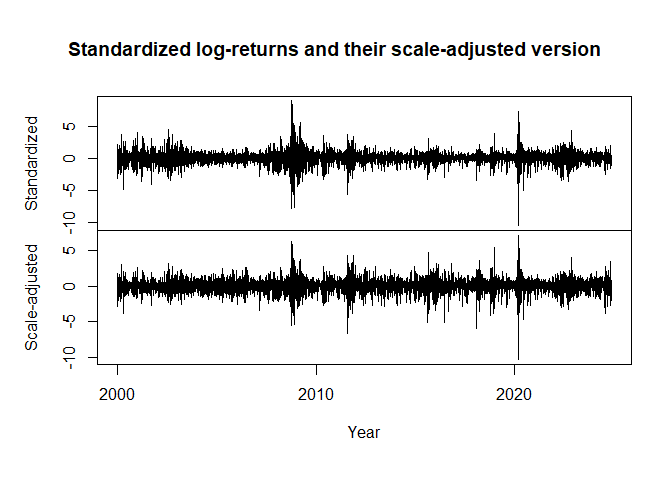

plot(cbind("Standardized" = (rt - mean(rt)) / sd(rt),

"Scale-adjusted" = (rt - mean(rt)) / model12@scale_fun),

xlab = "Year",

main = "Standardized log-returns and their scale-adjusted version")

The estimated volatility is then the product of the estimated scale function and the estimated conditional standard deviation both obtained at the corresponding time point.

Note that the returned AIC and BIC values are only valid for parametric model parts and are, in case of a semiparametric model, based on the scale-adjusted returns. A direct comparison of AIC and BIC values between purely parametric and semiparametric models is therefore not possible.

Estimation objects returned by fEGarch() contain several

elements. They can be either accessed through the operator

@ or via specific accessor functions named after the

corresponding elements in the output object. To access the fitted

conditional standard deviations, the fitted conditional means and the

standardized residuals, the package also alternatively provides methods

sigma(), fitted() and

residuals(), respectively.

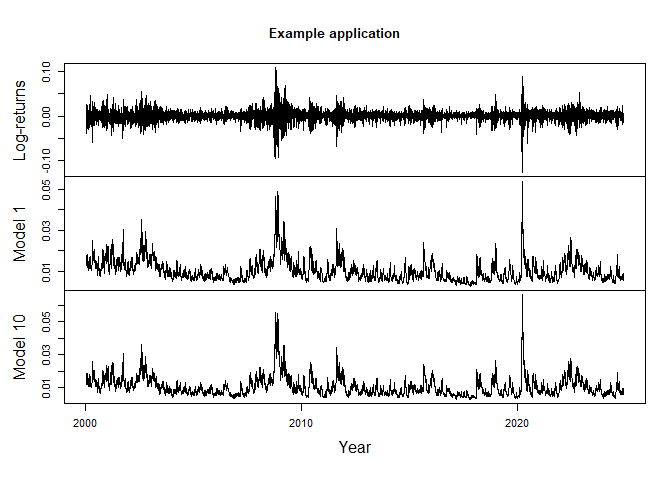

sigt1 <- sigt(model1)

sigt10 <- model10@sigt

TS <- cbind(

"Log-returns" = rt,

"Model 1" = sigt1,

"Model 10" = sigt10

)If the input data is formatted as a time series object of class

"zoo", fEGarch() applies the same formatting

to all output series in its returned object, also to the estimated

conditional standard deviations.

plot(TS, xlab = "Year", main = "Example application")

Furthermore, also the conditional means of the previously estimated

model11 object can be obtained.

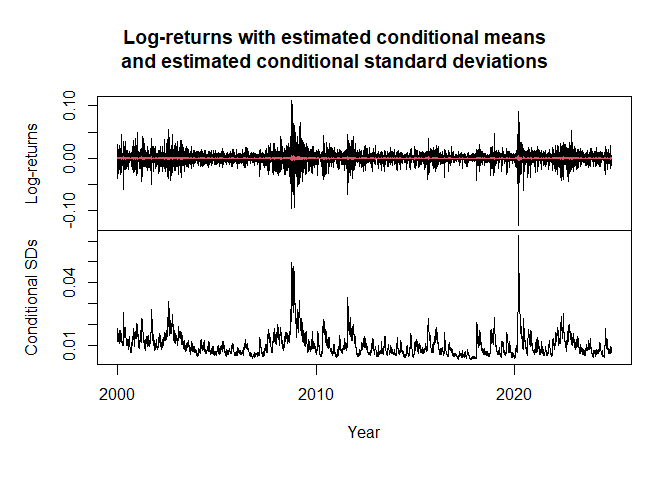

cond11 <- cmeans(model11)

sig11 <- sigt(model11)

plot.zoo <- get("plot.zoo", envir = asNamespace("zoo"))

obj <- cbind(

"Log-returns" = rt,

"Conditional means" = cond11,

"Conditional SDs" = sig11

)

plot.zoo(obj, screens = c(1, 1, 2), col = c(1, 2, 1),

main = paste0(

"Log-returns with estimated conditional means\n",

"and estimated conditional standard deviations"

),

xlab = "Year"

)

The fEGarch package also allows for the estimation of

FIAPARCH and FIGARCH models, however, currently only with fixed model

orders p = q = 1. For these two models, there are two fitting functions

figarch() and fiaparch() available without any

preceding model specification steps. Model specifications can be made

via arguments within these functions directly. Alternatively, the

wrapper garchm_estim() can be used to select and fit a

GARCH-type model (not belonging to the EGARCH family).

model_fiaparch <- rt %>%

fiaparch(orders = c(1, 1), cond_dist = "std")

model_fiaparch2 <- rt %>%

garchm_estim(model = "fiaparch", orders = c(1, 1), cond_dist = "std")

model_figarch <- rt %>%

figarch(orders = c(1, 1), cond_dist = "std")

model_figarch

#> *************************************

#> * Fitted FIGARCH Model *

#> *************************************

#>

#> Type: figarch

#> Orders: (1, 1)

#> Long memory: TRUE

#> Cond. distribution: std

#>

#> ARMA orders (cond. mean): (0, 0)

#> Long memory (cond. mean): FALSE

#>

#> Scale estimation: FALSE

#>

#> Fitted parameters:

#>

#> par se tval pval

#> mu 0.0008 0.0001 8.3454 0.0000

#> omega 0.0000 0.0000 3.3310 0.0009

#> phi1 0.0261 0.0328 0.7944 0.4269

#> beta1 0.6088 0.0557 10.9287 0.0000

#> d 0.6437 0.0571 11.2682 0.0000

#> df 6.4693 0.4858 13.3159 0.0000

#>

#> Information criteria (parametric part):

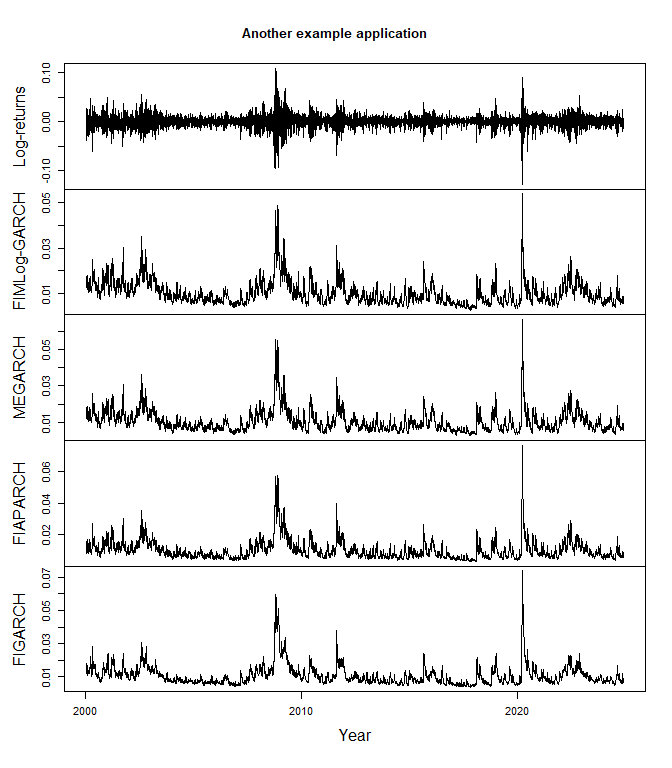

#> AIC: -6.5033, BIC: -6.4968sigt_fiaparch <- sigt(model_fiaparch)

sigt_figarch <- sigt(model_figarch)

TS2 <- cbind(

"Log-returns" = rt,

"FIMLog-GARCH" = sigt1,

"MEGARCH" = sigt10,

"FIAPARCH" = sigt_fiaparch,

"FIGARCH" = sigt_figarch

)

plot(TS2, xlab = "Year", main = "Another example application", nc = 1)

The package provides the two commands predict() and

predict_roll() to compute, given a fitted model from the

package, either multistep out-of-sample point forecasts of the

conditional standard deviation (and of the conditional mean) or rolling

point forecasts (of arbitrarily selectable step size) of the conditional

standard deviation (and of the conditional mean) over some reserved test

sample.

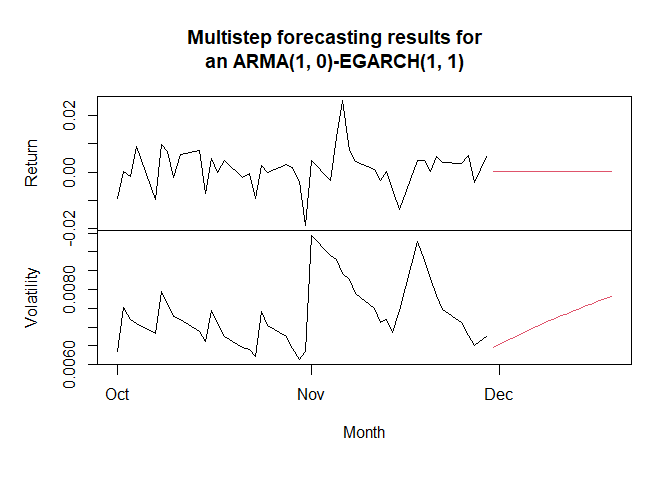

For multistep forecasts into the future, consider

predict and its argument n.ahead.

new_model <- egarch_spec() %>%

fEGarch(rt, meanspec = mean_spec(orders = c(1, 0)))

new_model

#> *************************************

#> * Fitted EGARCH Family Model *

#> *************************************

#>

#> Type: egarch

#> Orders: (1, 1)

#> Modulus: (FALSE, FALSE)

#> Powers: (1, 1)

#> Long memory: FALSE

#> Cond. distribution: norm

#>

#> ARMA orders (cond. mean): (1, 0)

#> Long memory (cond. mean): FALSE

#>

#> Scale estimation: FALSE

#>

#> Fitted parameters:

#>

#> par se tval pval

#> mu 0.0003 0.0000 9.8430 0.0000

#> ar1 -0.0498 0.0028 -17.8415 0.0000

#> omega_sig -9.1675 0.0627 -146.2110 0.0000

#> phi1 0.9719 0.0027 361.8563 0.0000

#> kappa -0.1353 0.0077 -17.4673 0.0000

#> gamma 0.1600 0.0124 12.9295 0.0000

#>

#> Information criteria (parametric part):

#> AIC: -6.4976, BIC: -6.4911

fc <- new_model %>%

predict(n.ahead = 20)

plot(

cbind(

"Return" = cmeans(fc),

"Volatility" = sigt(fc),

"Return_in" = window(new_model@rt, start = as.Date("2024-10-01")),

"Vol_in" = window(sigt(new_model), start = as.Date("2024-10-01"))

),

screens = c(1, 2, 1, 2),

col = c(2, 2, 1, 1),

main = "Multistep forecasting results for\nan ARMA(1, 0)-EGARCH(1, 1)",

xlab = "Month"

)

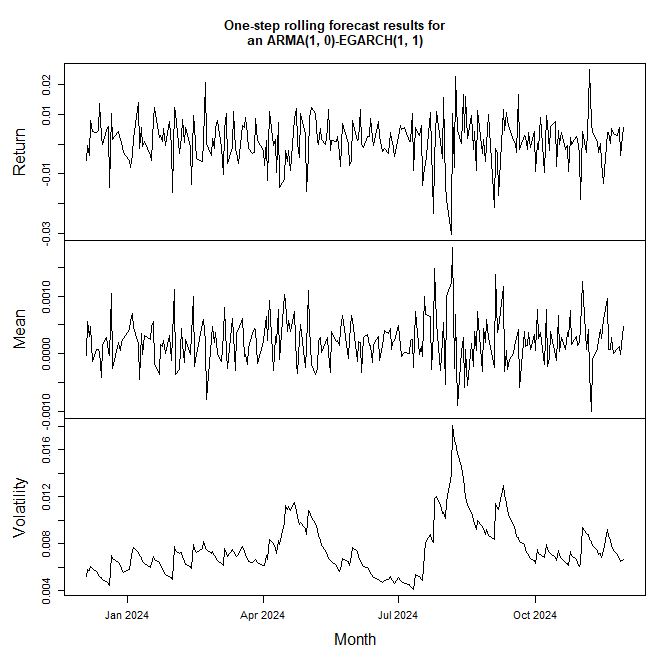

Rolling point forecasts can be computed using

predict_roll, if previously in the model estimation step

observations were reserved for testing using the argument

n_test.

new_model <- egarch_spec() %>%

fEGarch(rt, meanspec = mean_spec(orders = c(1, 0)), n_test = 250)

new_model

#> *************************************

#> * Fitted EGARCH Family Model *

#> *************************************

#>

#> Type: egarch

#> Orders: (1, 1)

#> Modulus: (FALSE, FALSE)

#> Powers: (1, 1)

#> Long memory: FALSE

#> Cond. distribution: norm

#>

#> ARMA orders (cond. mean): (1, 0)

#> Long memory (cond. mean): FALSE

#>

#> Scale estimation: FALSE

#>

#> Fitted parameters:

#>

#> par se tval pval

#> mu 0.0003 0.0000 7.3108 0.0000

#> ar1 -0.0516 0.0021 -24.1269 0.0000

#> omega_sig -9.1588 0.0659 -139.0742 0.0000

#> phi1 0.9727 0.0027 363.9059 0.0000

#> kappa -0.1359 0.0079 -17.2996 0.0000

#> gamma 0.1591 0.0126 12.6411 0.0000

#>

#> Information criteria (parametric part):

#> AIC: -6.4792, BIC: -6.4726

fc2 <- new_model %>%

predict_roll()

plot(

cbind(

"Return" = new_model@test_obs,

"Mean" = cmeans(fc2),

"Volatility" = sigt(fc2)

),

screens = c(1, 2, 3),

main = "One-step rolling forecast results for\nan ARMA(1, 0)-EGARCH(1, 1)",

xlab = "Month"

)

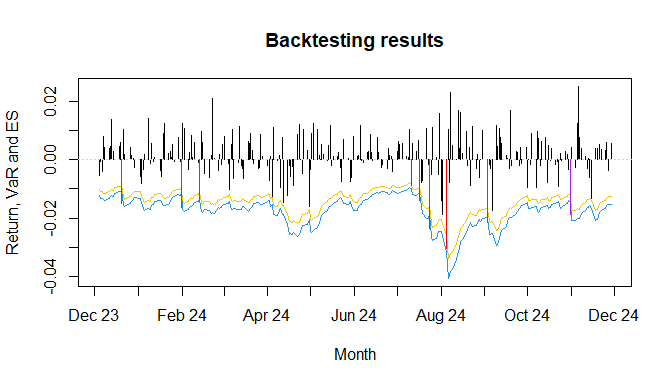

The results from one-step rolling point forecasts for the conditional

mean and the conditional standard deviation for test time points can be

used for common backtesting approaches. first and foremost, the

resulting object from a call to predict_roll can be fed to

measure_risk to compute value at risk (VaR) and expected

shortfall (ES) following those forecasts and the underlying conditional

distribution.

risk <- fc2 %>%

measure_risk()By default, the 97.5% and the 99% VaR and ES will be computed. A

plotting method (also additionally available as autoplot

for compatibility with the ggplot2 framework) allows for

plotting the test returns together with the VaR and ES of a selected

confidence level from the output of measure_risk.

risk %>%

plot(which = 0.975, xlab = "Month")

As can be seen, the breaches of the VaR are automatically highlighted

through the colors red and purple. Breaches of the ES (and therefore

implied also of the VaR) are shown through the color purple alone.

Furthermore, time series formatting of "zoo" objects is

kept for simplified formatting of the x-axis.

Moreover, a test suite consisting of traffic light tests for VaR and

ES and of coverage and independence tests can be applied using

backtest_suite on the output of

measure_risk.

risk %>%

backtest_suite()

#>

#> ***********************

#> * Traffic light tests *

#> ***********************

#>

#> VaR results:

#> ************

#>

#> Conf. level: 0.975

#> Breaches: 9

#> Cumul. prob.: 0.9005

#> Zone: Green zone

#>

#> Conf. level: 0.99

#> Breaches: 7

#> Cumul. prob.: 0.9960

#> Zone: Yellow zone

#>

#>

#> ES results:

#> ***********

#>

#> Conf. level: 0.975

#> Severity of breaches: 6.9709

#> Cumul. prob.: 0.9964

#> Zone: Yellow zone

#>

#> Conf. level: 0.99

#> Severity of breaches: 5.0001

#> Cumul. prob.: 1.0000

#> Zone: Red zone

#>

#>

#>

#> *******************************

#> * Weighted Absolute Deviation *

#> *******************************

#>

#> Following 99%-VaR, 97.5%-VaR and 97.5%-ES.

#>

#> WAD: 3.4707

#>

#>

#> ***************************************

#> * Unconditional coverage test for VaR *

#> ***************************************

#>

#> H0: true share of covered observations = theoretical share of VaR

#>

#> Conf. level: 0.975

#> Breaches: 9

#> Test statistic: 1.0947

#> p-value: 0.2954

#> Decision: Do not reject H0

#>

#> Conf. level: 0.99

#> Breaches: 7

#> Test statistic: 5.4970

#> p-value: 0.0190

#> Decision: Reject H0

#>

#>

#> *****************************

#> * Independence test for VaR *

#> *****************************

#>

#> H0: true share of covered observations independent

#> of breach or no breach at previous time point

#>

#> Conf. level: 0.975

#> Breaches: 9

#> Test statistic: 0.6752

#> p-value: 0.4113

#> Decision: Do not reject H0

#>

#> Conf. level: 0.99

#> Breaches: 7

#> Test statistic: 0.4050

#> p-value: 0.5245

#> Decision: Do not reject H0

#>

#>

#> *************************************

#> * Conditional coverage test for VaR *

#> *************************************

#>

#> H0: true share of covered observations simultaneously

#> independent of breach or no breach at previous time point

#> and equal to theoretical share of VaR

#>

#> Conf. level: 0.975

#> Breaches: 9

#> Test statistic: 1.7927

#> p-value: 0.4081

#> Decision: Do not reject H0

#>

#> Conf. level: 0.99

#> Breaches: 7

#> Test statistic: 5.9388

#> p-value: 0.0513

#> Decision: Do not reject H0Ultimately, the package is also capable of computing loss functions based on VaR and ES. For detailed description of those loss functions, see the manual of the package.

# Output suppressed to save space

risk %>%

loss_functions(penalty = 1e-04)A better model regarding VaR and ES forecasting for this particular example could be implemented and checked as follows.

# Fit and check an ARMA(1, 0)-FILog-GARCH(1, d, 1) with

# conditional t-distribution

new_model2 <- filoggarch_spec(cond_dist = "std") %>%

fEGarch(rt, n_test = 250, meanspec = mean_spec(orders = c(1, 0)))

risk_nm2 <- new_model2 %>%

predict_roll() %>%

measure_risk()

risk_nm2 %>%

backtest_suite()

#>

#> ***********************

#> * Traffic light tests *

#> ***********************

#>

#> VaR results:

#> ************

#>

#> Conf. level: 0.975

#> Breaches: 8

#> Cumul. prob.: 0.8229

#> Zone: Green zone

#>

#> Conf. level: 0.99

#> Breaches: 4

#> Cumul. prob.: 0.8922

#> Zone: Green zone

#>

#>

#> ES results:

#> ***********

#>

#> Conf. level: 0.975

#> Severity of breaches: 4.8054

#> Cumul. prob.: 0.8801

#> Zone: Green zone

#>

#> Conf. level: 0.99

#> Severity of breaches: 1.2110

#> Cumul. prob.: 0.4829

#> Zone: Green zone

#>

#>

#>

#> *******************************

#> * Weighted Absolute Deviation *

#> *******************************

#>

#> Following 99%-VaR, 97.5%-VaR and 97.5%-ES.

#>

#> WAD: 1.4177

#>

#>

#> ***************************************

#> * Unconditional coverage test for VaR *

#> ***************************************

#>

#> H0: true share of covered observations = theoretical share of VaR

#>

#> Conf. level: 0.975

#> Breaches: 8

#> Test statistic: 0.4624

#> p-value: 0.4965

#> Decision: Do not reject H0

#>

#> Conf. level: 0.99

#> Breaches: 4

#> Test statistic: 0.7691

#> p-value: 0.3805

#> Decision: Do not reject H0

#>

#>

#> *****************************

#> * Independence test for VaR *

#> *****************************

#>

#> H0: true share of covered observations independent

#> of breach or no breach at previous time point

#>

#> Conf. level: 0.975

#> Breaches: 8

#> Test statistic: 0.5312

#> p-value: 0.4661

#> Decision: Do not reject H0

#>

#> Conf. level: 0.99

#> Breaches: 4

#> Test statistic: 0.1306

#> p-value: 0.7178

#> Decision: Do not reject H0

#>

#>

#> *************************************

#> * Conditional coverage test for VaR *

#> *************************************

#>

#> H0: true share of covered observations simultaneously

#> independent of breach or no breach at previous time point

#> and equal to theoretical share of VaR

#>

#> Conf. level: 0.975

#> Breaches: 8

#> Test statistic: 1.0081

#> p-value: 0.6041

#> Decision: Do not reject H0

#>

#> Conf. level: 0.99

#> Breaches: 4

#> Test statistic: 0.9120

#> p-value: 0.6338

#> Decision: Do not reject H0resids <- new_model@etat

test_obs <- new_model@test_obs

sigt <- fc2@sigt

cmeans <- fc2@cmeansAssume now that the objects resids,

test_obs, sigt and cmeans reflect

the in-sample standardized residuals obtained from some model, the test

returns, one-step rolling point forecasts of the conditional standard

deviation for the same test period and the one-step rolling point

forecasts of the conditional mean for the same test period,

respectively. Furthermore, also assume that they were not obtained

through a parametric (or semiparametric) GARCH-type model but through

some fully nonparametric idea like for example a neural network. Given

those series, the fEGarch package provides a simple way to

compute and backtest VaR and ES even for such nonparametric

approaches.

opt_dist <- resids %>%

find_dist(fix_mean = 0, fix_sdev = 1, criterion = "bic")

opt_dist

#> *************************************

#> * Fitted Distribution *

#> *************************************

#>

#> Distribution: sald

#> Fixed: 0 (mean), 1 (sdev)

#>

#> Fitted parameters:

#>

#> par se tval pval

#> P 2.0000 NA NA NA

#> skew 0.8580 0.0142 60.4713 0.0000

#>

#> Information criteria:

#> AIC: 2.7878, BIC: 2.7900

risk_obj <- opt_dist %>%

measure_risk(test_obs = test_obs, sigt = sigt, cmeans = cmeans)find_dist() uses maximum-likelihood estimation on the

in-sample standardized residual series to find the best distribution

among the eight available innovation distributions in this package

following either the BIC (the default) or the AIC. This returns an

object of class "fEGarch_distr_est", for which there is a

special method of measure_risk(). Therefore, to compute the

VaR and ES forecasts, feed the output of find_dist() to

measure_risk() while also supplying the function with the

objects test_obs, sigt and

cmeans. The output is now formatted identically to that of

the measure_risk() method applied to the output of

predict_roll() for GARCH-type models and can be treated the

same as before.

risk_obj %>%

plot(which = 0.975, xlab = "Month")

# Inclusion of the output is omitted here to save space.risk_obj %>%

backtest_suite()

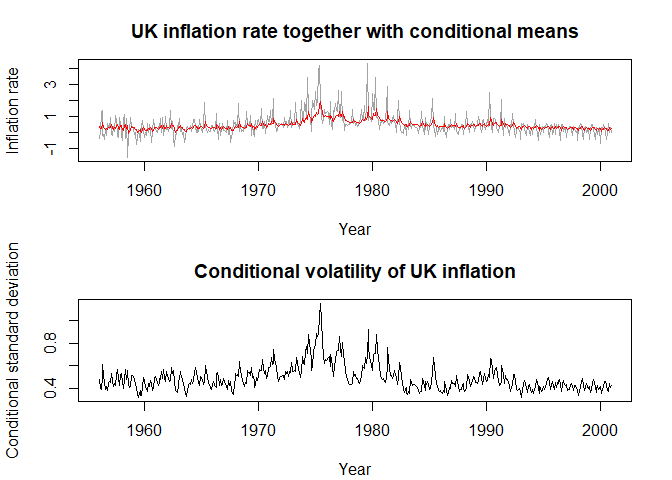

# Inclusion of the output is omitted here to save space.The package allows for the implementation of dual long-memory models

(long-memory in mean together with long-memory in volatility), which can

be useful for applications to non-return data as well. In the following,

a FARIMA(0, d ,1)-FIMLog-GARCH(1, d, 1) model (with conditional skewed

average Laplace distribution) is applied to the data

UKinflation, which contains monthly UK inflation rates over

time and which is provided in the package.

xt <- UKinflation

dual_lm_model <- fimloggarch_spec(cond_dist = "sald") %>%

fEGarch(xt, meanspec = mean_spec(orders = c(0, 1), long_memo = TRUE))

dual_lm_model

#> *************************************

#> * Fitted EGARCH Family Model *

#> *************************************

#>

#> Type: egarch

#> Orders: (1, 1)

#> Modulus: (TRUE, TRUE)

#> Powers: (0, 0)

#> Long memory: TRUE

#> Cond. distribution: sald

#>

#> ARMA orders (cond. mean): (0, 1)

#> Long memory (cond. mean): TRUE

#>

#> Scale estimation: FALSE

#>

#> Fitted parameters:

#>

#> par se tval pval

#> mu 0.4038 0.0423 9.5449 0.0000

#> ma1 -0.0054 0.0018 -2.9887 0.0028

#> D 0.2322 0.0076 30.6137 0.0000

#> omega_sig -1.4809 0.0934 -15.8469 0.0000

#> phi1 0.7217 0.1246 5.7938 0.0000

#> kappa 0.3394 0.0989 3.4302 0.0006

#> gamma 0.0331 0.1021 0.3242 0.7458

#> d 0.1574 0.1314 1.1981 0.2309

#> P 1.0000 NA NA NA

#> skew 1.2916 0.0690 18.7204 0.0000

#>

#> Information criteria (parametric part):

#> AIC: 1.3413, BIC: 1.4208

oldpar <- par(no.readonly = TRUE)

par(mfrow = c(2, 1), cex = 1, mar = c(4, 4, 3, 2) + 0.1)

ts.plot(xt, fitted(dual_lm_model), col = c("grey64", "red"),

xlab = "Year", ylab = "Inflation rate",

main = "UK inflation rate together with conditional means")

plot.ts(sigma(dual_lm_model), xlab = "Year",

ylab = "Conditional standard deviation",

main = "Conditional volatility of UK inflation")

par(oldpar)The main functions of the package are:

fEGarch_spec(): general EGARCH family model

specification,

fEGarch(): fitting function for models of the

broader EGARCH family,

garchm_estim(): GARCH-type model fitting selectable

from standard GARCH, GJR-GARCH, TGARCH, APARCH, FIGARCH, FIGJR-GARCH,

FITGARCH and FIAPARCH.

fEGarch_sim(): EGARCH family simulation,

fiaparch_sim(): FIAPARCH simulation,

figarch_sim(): FIGARCH simulation,

figjrgarch_sim(): FIGJR-GARCH simulation,

fitgarch_sim(): FITGARCH simulation,

aparch_sim(): APARCH simulation,

garch_sim(): GARCH simulation,

gjrgarch_sim(): GJR-GARCH simulation,

tgarch_sim(): TGARCH simulation,

mean_spec(): ARMA or FARIMA model specification for

simultaneously modelling the conditional mean,

predict(): a forecasting method to compute multistep

point forecasts of the conditional mean and the conditional standard

deviation following one of the package’s fitted models,

predict_roll(): a method to compute rolling point

forecasts of the conditional mean and the conditional standard deviation

over a test set following one of the package’s fitted models.

measure_risk(): given certain input objects with

information about (forecasts of) conditional standard deviation and

conditional mean, computes the corresponding (forecasts of) VaR and

ES.

backtest_suite(): a collection of tests for

backtesting of VaR and ES.

find_dist(): fits all eight distributions considered

in this package to a supposed iid series and selects the best fitted

distribution following either BIC (the default) or AIC.

The package, however, provides many other useful functions to discover.

The package contains an example time series SP500,

namely the Standard and Poor’s 500 daily log-return series from January

04, 2000, until November 30, 2024, obtained from Yahoo Finance. The

series is formatted as a time series object of class "zoo".

Furthermore, it contains the dataset UKinflation with the

monthly inflation rate of the UK from January 1956 to December 2000.

This second series is formatted as a time series of class

"ts".

Dominik Schulz (Department Economics, Paderborn University, Germany) (Author, Maintainer)

Yuanhua Feng (Department Economics, Paderborn University, Germany) (Author)

Christian Peitz (Financial Intelligence Unit, German Government) (Author)

Oliver Kojo Ayensu (Department Economics, Paderborn University, Germany) (Author)

For questions, bug reports, etc., please contact the maintainer Mr. Dominik Schulz via dominik.schulz@uni-paderborn.de.

If you are using this software for your publication, please consider citing

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.