The hardware and bandwidth for this mirror is donated by METANET, the Webhosting and Full Service-Cloud Provider.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]metanet.ch.

nortsTest is an R package for assessing

normality of stationary processes, it tests if a given data follows a

stationary Gaussian process. The package works as an extension of the

nortest package that performs normality tests in random

samples (independent data). The package’s principal functions

are:

elbouch.test() function that computes the bivariate

El Bouch et

al. test,

epps.test() function that implements the Epps

test,

epps-bootstrap.test() function that implements the

Epps test,

approximating the p-values using a sieve-bootstrap procedure.

lobato.test() function that implements the Lobato

and Velasco’s test,

lobato-bootstrap.test() function that implements the

Lobato and Velasco’s test, approximating the p-values using a

sieve-bootstrap procedure.

rp.test() function that implements the random

projections test of Nieto-Reyes, Cuesta-Albertos and Gamboa’s

test,

vavra.test() function that implements the Psaradakis and Vávra’s

test,

jb-bootstrap.test() function that implements the

Jarque and Bera test, approximating the p-values using a sieve-bootstrap

procedure,

shapiro-bootstrap.test() function that implements

the Shapiro test, approximating the p-values using a sieve-bootstrap

procedure,

cvm-bootstrap.test() function that implements the

Cramer Von Mises test, approximating the p-values using a

sieve-bootstrap procedure.

Additionally, inspired in the function checkresiduals()

of the forecast

package, we provide the check_residuals methods for

checking model’s assumptions using the estimated residuals. The function

checks stationarity, homoscedasticity and normality, presenting a report

of the used tests and conclusions.

library(nortsTest)Classic hypothesis tests for normality such as Shapiro & Wilk,

Anderson & Darling, or Jarque & Bera, do not perform well on

dependent data. Therefore, these tests should not be used to check

whether a given time series has been drawn from a Gaussian process. As a

simple example, we generate a stationary ARMA(1,1) process simulated

using an t student distribution with 7 degrees of freedom, and perform

the Anderson-Darling test from the nortest package.

x = arima.sim(100,model = list(ar = 0.32,ma = 0.25),rand.gen = rt,df = 7)

nortest::ad.test(x)

#>

#> Anderson-Darling normality test

#>

#> data: x

#> A = 0.50769, p-value = 0.1954The null hypothesis is that the data has a normal distribution and therefore, follows a Gaussian Process. At \(\alpha = 0.05\) significance level the alternative hypothesis is rejected and wrongly concludes the data follows a Gaussian process. Applying the Lobato and Velasco’s test of our package, the null hypothesis is correctly rejected.

lobato.test(x)

#>

#> Lobatos and Velascos test

#>

#> data: x

#> lobato = 16.864, df = 2, p-value = 0.0002177

#> alternative hypothesis: x does not follow a Gaussian ProcessIn the next example we generate a stationary AR(2) process, using an

exponential distribution with rate of 5, and perform the Epps

and RP with k = 5 random projections tests. With a

significance level at \(\alpha=0.05\),

the null hypothesis of non-normality is rejected.

set.seed(298)

# Simulating the AR(2) process

x = arima.sim(250,model = list(ar =c(0.2,0.3)),rand.gen = rexp,rate = 5)

# tests

epps.test(x)

#>

#> epps test

#>

#> data: x

#> epps = 38.158, df = 2, p-value = 5.178e-09

#> alternative hypothesis: x does not follow a Gaussian Process

rp.test(x,k = 5)

#>

#> k random projections test

#>

#> data: x

#> k = 5, lobato = 188.771, epps = 28.385, p-value = 0.0007823

#> alternative hypothesis: x does not follow a Gaussian ProcessIn the next example we generate a stationary VAR(1) process of

dimension p = 2, using two independent Gaussian AR(1)

processes, and perform the El Bouch’s test. With a significance

level of \(\alpha = 0.05\), the

alternative hypothesis of non-normality is rejected.

set.seed(298)

# Simulating the VAR(2) process

x1 = arima.sim(250, model = list(ar =c (0.2)))

x2 = arima.sim(250, model = list(ar =c (0.3)))

#

# test

elbouch.test(y = x1, x = x2)

#>

#> El Bouch, Michel & Comon's test

#>

#> data: w = (y, x)

#> Z = 0.1438, p-value = 0.4428

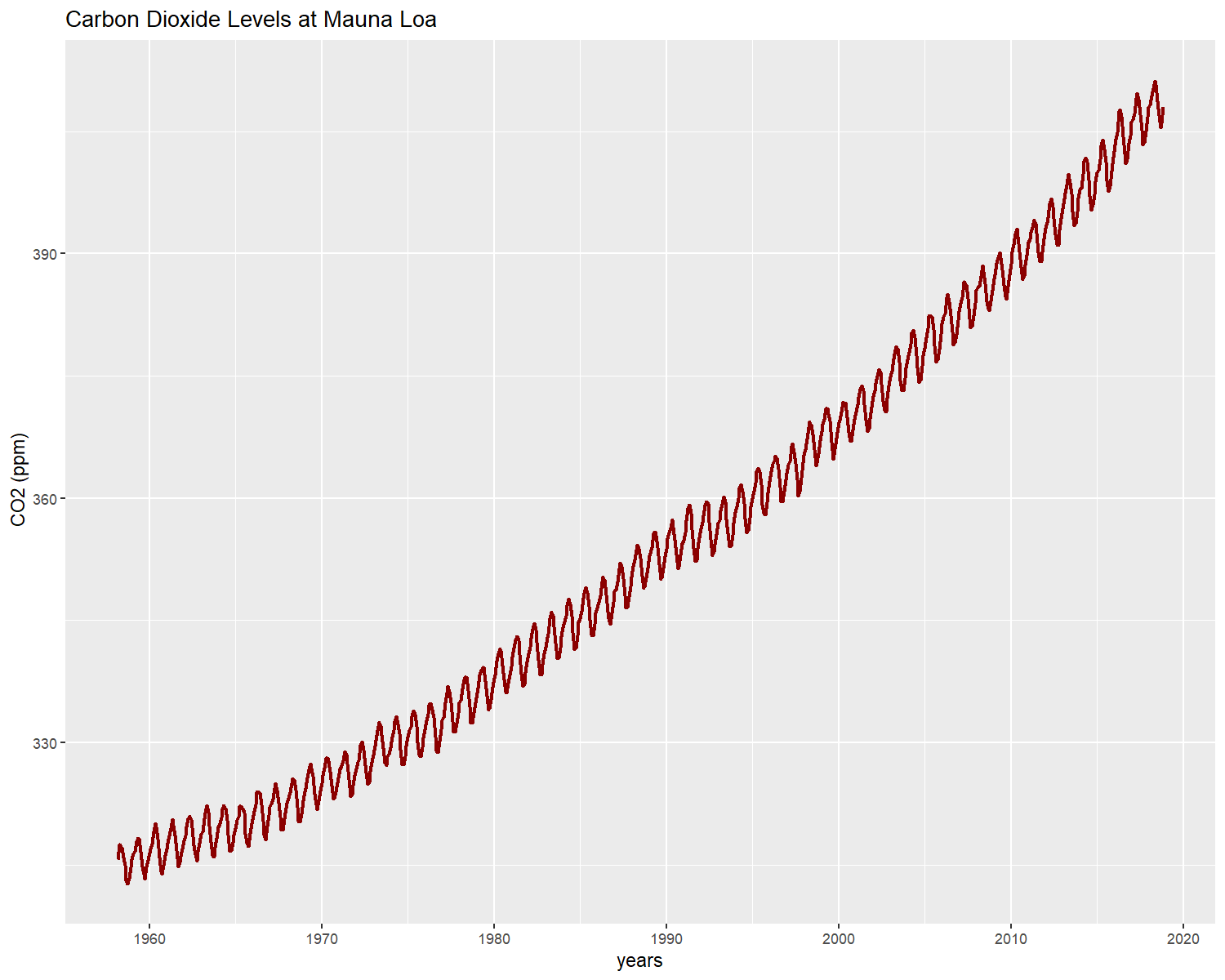

#> alternative hypothesis: w = (y, x) does not follow a Gaussian Processcardox dataAs an example, we analyze the monthly mean carbon dioxide (in

ppm) from the astsa package, measured at Mauna Loa

Observatory, Hawaii. from March, 1958 to November 2018. The carbon

dioxide data measured as the mole fraction in dry air, on Mauna Loa

constitute the longest record of direct measurements of CO2 in the

atmosphere. They were started by C. David Keeling of the Scripps

Institution of Oceanography in March of 1958 at a facility of the

National Oceanic and Atmospheric Administration.

library(astsa)

data("cardox")

autoplot(cardox,xlab = "years",ylab = " CO2 (ppm)",color = "darkred",

size = 1,main = "Carbon Dioxide Levels at Mauna Loa")

The time series clearly has trend and seasonal components, for analyzing the cardox data we proposed a Gaussian linear state space model. We use the model’s implementation from the forecast package as follows:

library(forecast)

#>

#> Attaching package: 'forecast'

#> The following object is masked from 'package:astsa':

#>

#> gas

model = ets(cardox)

summary(model)

#> ETS(M,A,A)

#>

#> Call:

#> ets(y = cardox)

#>

#> Smoothing parameters:

#> alpha = 0.5591

#> beta = 0.0072

#> gamma = 0.1061

#>

#> Initial states:

#> l = 314.6899

#> b = 0.0696

#> s = 0.6611 0.0168 -0.8536 -1.9095 -3.0088 -2.7503

#> -1.2155 0.6944 2.1365 2.7225 2.3051 1.2012

#>

#> sigma: 9e-04

#>

#> AIC AICc BIC

#> 3136.280 3137.140 3214.338

#>

#> Training set error measures:

#> ME RMSE MAE MPE MAPE MASE

#> Training set 0.0232403 0.312003 0.2430829 0.006308831 0.06883992 0.1559102

#> ACF1

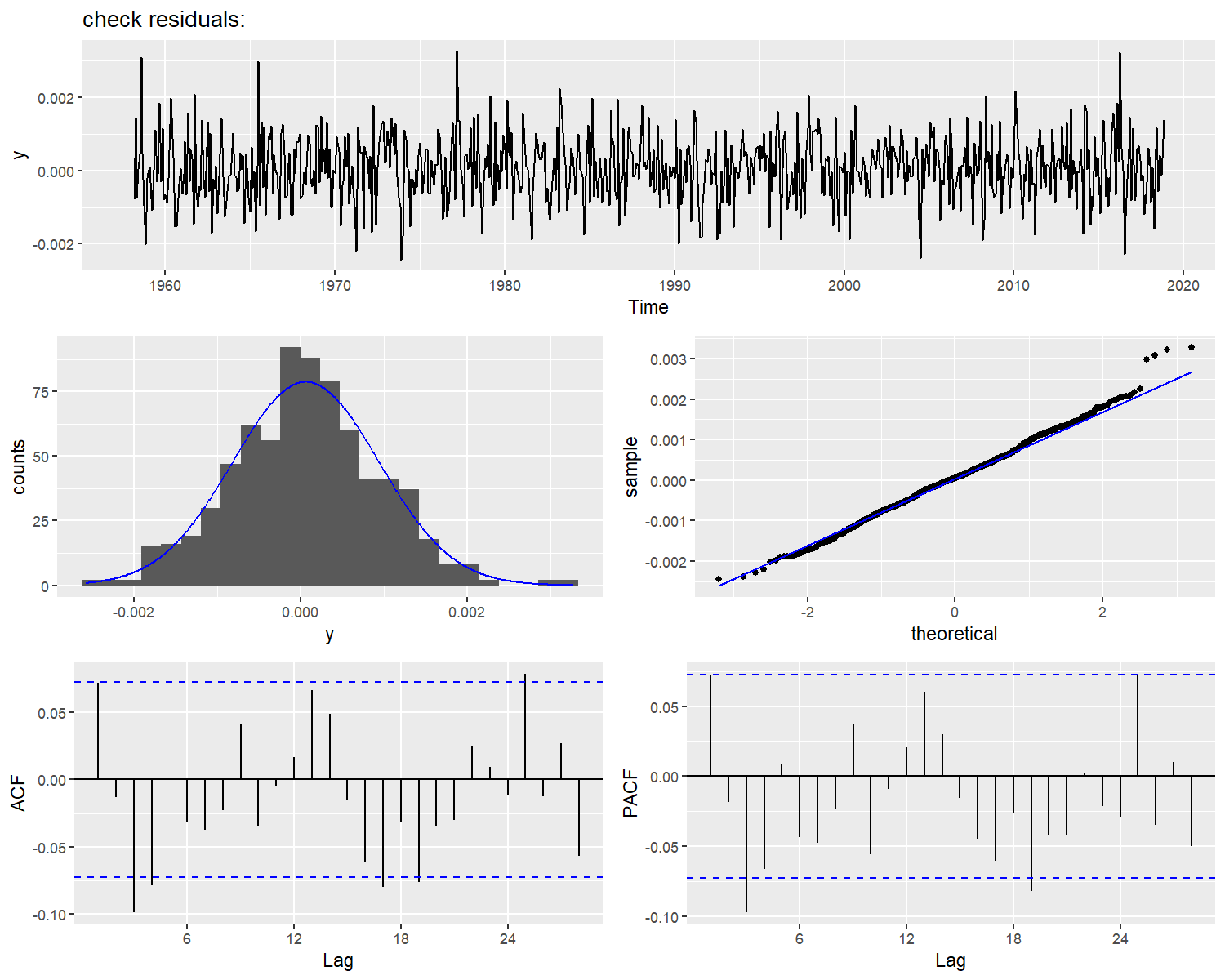

#> Training set 0.07275949The best fitted model is a multiplicative level,

additive trend and seasonality state space model. If

the model’s assumptions are satisfied, then the model’s errors behave

like a Gaussian stationary process. These assumptions can be checked

using our check_residuals functions.

In this case, we use an Augmented Dickey-Fuller test for stationary assumption, and a random projections test for normality.

check_residuals(model,unit_root = "adf",normality = "rp",plot = TRUE)

#>

#> ***************************************************

#>

#> Unit root test for stationarity:

#>

#> Augmented Dickey-Fuller Test

#>

#> data: y

#> Dickey-Fuller = -9.7249, Lag order = 8, p-value = 0.01

#> alternative hypothesis: stationary

#>

#>

#> Conclusion: y is stationary

#> ***************************************************

#>

#> Goodness of fit test for Gaussian Distribution:

#>

#> k random projections test

#>

#> data: y

#> k = 2, lobato = 3.8260, epps = 1.3156, p-value = 0.3328

#> alternative hypothesis: y does not follow a Gaussian Process

#>

#>

#> Conclusion: y follows a Gaussian Process

#>

#> ***************************************************

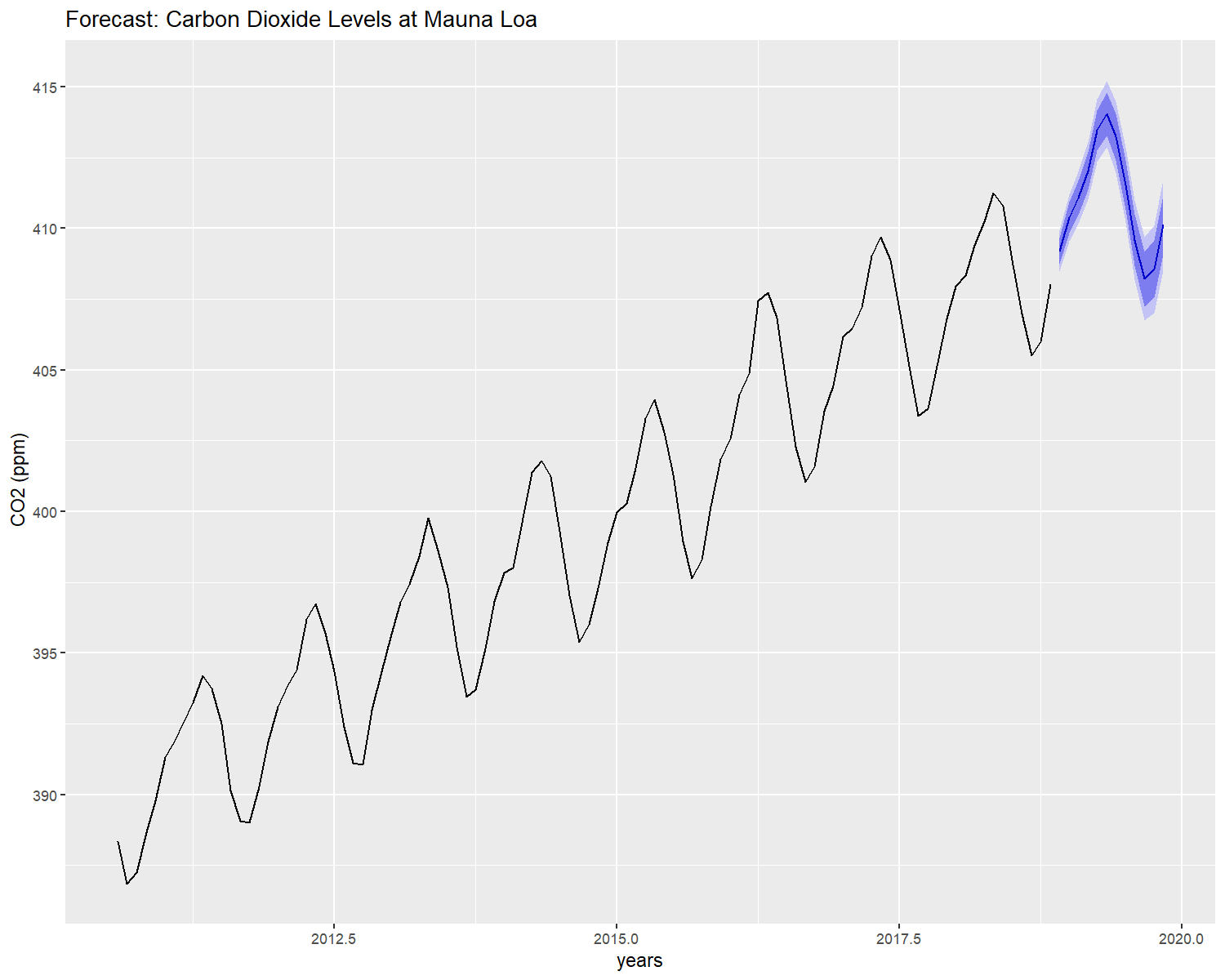

After all the model’s assumptions are checked, the model can be used to forecast.

autoplot(forecast(model,h = 12),include = 100,xlab = "years",ylab = " CO2 (ppm)",

main = "Forecast: Carbon Dioxide Levels at Mauna Loa")

nortsTest?The current development version can be downloaded from GitHub via

if (!requireNamespace("remotes")) install.packages("remotes")

remotes::install_github("asael697/nortsTest",dependencies = TRUE)The nortsTest package offers additional functions for

descriptive analysis in univariate time series.

uroot.test: performs unit root test for checking

stationary in linear time series. The Ljung-Box, Augmented

Dickey-Fuller, Phillips-Perron and Kpps tests can be selected with the

unit_root option parameter.

seasonal.test: performs seasonal unit root test for

stationary in seasonal time series. The hegy,

ch and ocsb tests are available with the

seasonal option parameter.

arch.test: for checking the ARCH effect in time

series. The Ljung-Box and Lagrange Multiplier tests can be selected from

the arch option parameter.

normal.test: for normal distribution check in time

series and random samples. The tests presented above can be chosen for

stationary time series. For random samples (independent data),

the Anderson & Darling, Shapiro & Wilk’s, and Jarque-Bera tests

are available with the normality option parameter.

For visual diagnostic, we offer ggplot2 methods for numeric and time-series data. Most of the functions were adapted from Rob Hyndman’s forecast package.

autoplot: For plotting time series objects

(ts class*).

gghist: histograms for numeric and univariate time

series.

ggnorm: quantile-quantile plot for numeric and

univariate time series.

ggacf & ggpacf: partial and auto

correlation functions plots for numeric and univariate time

series.

check_plot: summary diagnostic plot for univariate

stationary time series.

Currently our check_residuals() and

check_plot() methods are valid for the current models and

classes:

ts: for univariate time series

numeric: for numeric vectors

arima0: from the stats package

Arima: from the forecast

package

fGARCH: from the fGarch

package

lm: from the stats package

glm: from the stats package

Holt and Winters: from the

stats and forecast package

ets: from the forecast package

forecast methods: from the forecast

package.

For overloading more functions, methods or packages, please make a

pull request or send a mail to: asael_am@hotmail.com.

El Bouch, S., Michel, O. & Comon, P. (2022). A normality test for Multivariate dependent samples. Journal of Signal Processing. Volume 201.

Psaradakis, Z. and Vávra, M. (2020) Normality tests for dependent data: large-sample and bootstrap approaches. Communications in Statistics-Simulation and Computation. 49 (2), ISSN 0361-0918.

Psaradakis, Z. & Vávra, M. (2017). A distance test of normality for a wide class of stationary process. Journal of Econometrics and Statistics. 2, 50-60.

Nieto-Reyes, A., Cuesta-Albertos, J. & Gamboa, F. (2014). A random-projection based test of Gaussianity for stationary processes. Computational Statistics & Data Analysis, Elsevier. 75(C), 124-141.

Hyndman, R. & Khandakar, Y. (2008). Automatic time series forecasting: the forecast package for R. Journal of Statistical Software. 26(3), 1-22.

Lobato, I., & Velasco, C. (2004). A simple test of normality for time series. Journal Econometric Theory. 20(4), 671-689.

Epps, T.W. (1987). Testing that a stationary time series is Gaussian. The Annals of Statistic. 15(4), 1683-1698.

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.