The hardware and bandwidth for this mirror is donated by METANET, the Webhosting and Full Service-Cloud Provider.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]metanet.ch.

Portfolio level unconditional as well as conditional risk measure estimation for backtesting and stress testing using Vine Copula and ARMA-GARCH models. The package implements the proposed approaches in Sommer (2022) and Sommer et al. (2023).

You can install the released version of portvine from CRAN with:

install.packages("portvine")You can install the development version of portvine from

GitHub with:

# install.packages("devtools")

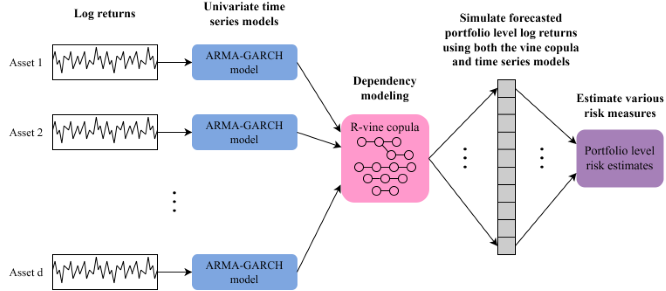

devtools::install_github("EmanuelSommer/portvine")The implemented algorithms for the unconditional as well as conditional portfolio level risk measure estimation are based on my masters thesis at the chair of Mathematical Statistics at the TUM which you can find here. The general idea of the unconditional risk measure estimation approach is summarized in the flowchart below for a \(d\)-dimensional portfolio.

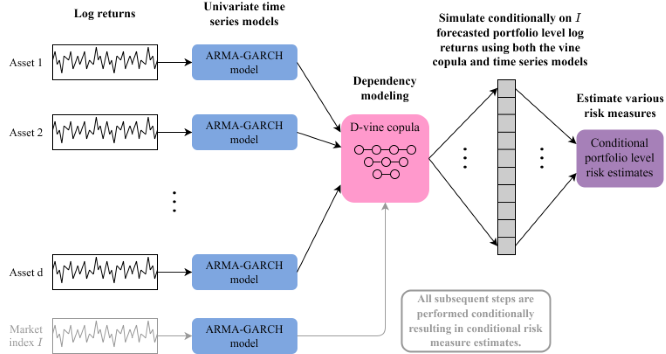

For the single conditional approach the general idea for a \(d\)-dimensional portfolio and a market index \(I\) is summarized in the flowchart below.

If you want to get your hands dirty fast the Get Started vignette is a perfect fit for you as it showcases a minimal case study with a lot of code examples and some handy visualization functions that were not incorporated into the package as they are highly opinionated.

In order to grasp what is going on under the hood a look at the Under the hood article on the package website is advised before starting to use the package. There the most important algorithms used during the risk measure estimation are explained. If this doesn’t saturate your hunger for the theory behind the package you should take a look at Sommer (2022).

Moreover the help pages are quite detailed so feel free to have a look at them.

The risk estimation algorithms implemented in this package lend

themselves perfectly for parallel processing. In this package this is

enabled through the in my humble opinion amazing future framework.

For details please have a look at the detailed section on parallel

processing within the help page of the estimate_risk_roll()

function (or function reference on the package website). Some

performance measurements of different parallel strategies and further

information on the implemented parallelisms are presented in the

Parallel processing article on the package website.

This package is built on the shoulder of giants most importantly the

R packages rvinecopulib

and rugarch.

Thus a big thanks goes to all the contributors and maintainers! Also I

would like to thank Claudia Czado and Karoline Bax for giving me the

opportunity to work on this project in the first place and their

dedicated collaboration along the way!

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.